Unless you’re new to finance, the term credit score isn’t something new to you. As many people like to put it, your credit score is usually your financial CV. Like your CV influences opportunities in the job market world, your credit score commands your borrowing options. If you’re unsure of your credit score and what it means to have a good rating, this article is rightfully meant for you.

Keep on reading!

What is a credit score?

Your credit score is a three digit figure that banks and lenders use to gauge how likely you are to pay debts. The higher your score, the better.

The three main factors that determine your score are:

- Your history of paying bills on time.

- The average size of your debt.

- Available credit for loans

Lenders use this number to determine potential risks. It tells lenders that you’re likely to pay your debts on time and, if you don’t, that you’ve been making the payments because you’re in trouble, but then you get out of trouble, and you’ll pay them back when you can. Lenders will use credit scores to determine what interest rate they’ll apply.

Your credit score can help enhance your financial life. A higher credit score will make it easier for you to get credit and, once you get it, improve your credit rating by having a low credit utilization rate (the portion of available credit you’ve used in the past 12 months as a percentage total of the available credit limit).

Having a low credit utilization rate will help you maintain a good payment history and get the credit you’ll need when you need it. If you have a low credit utilization rate right now, you’re more likely not to get into credit trouble with another loan.

What is a good credit score?

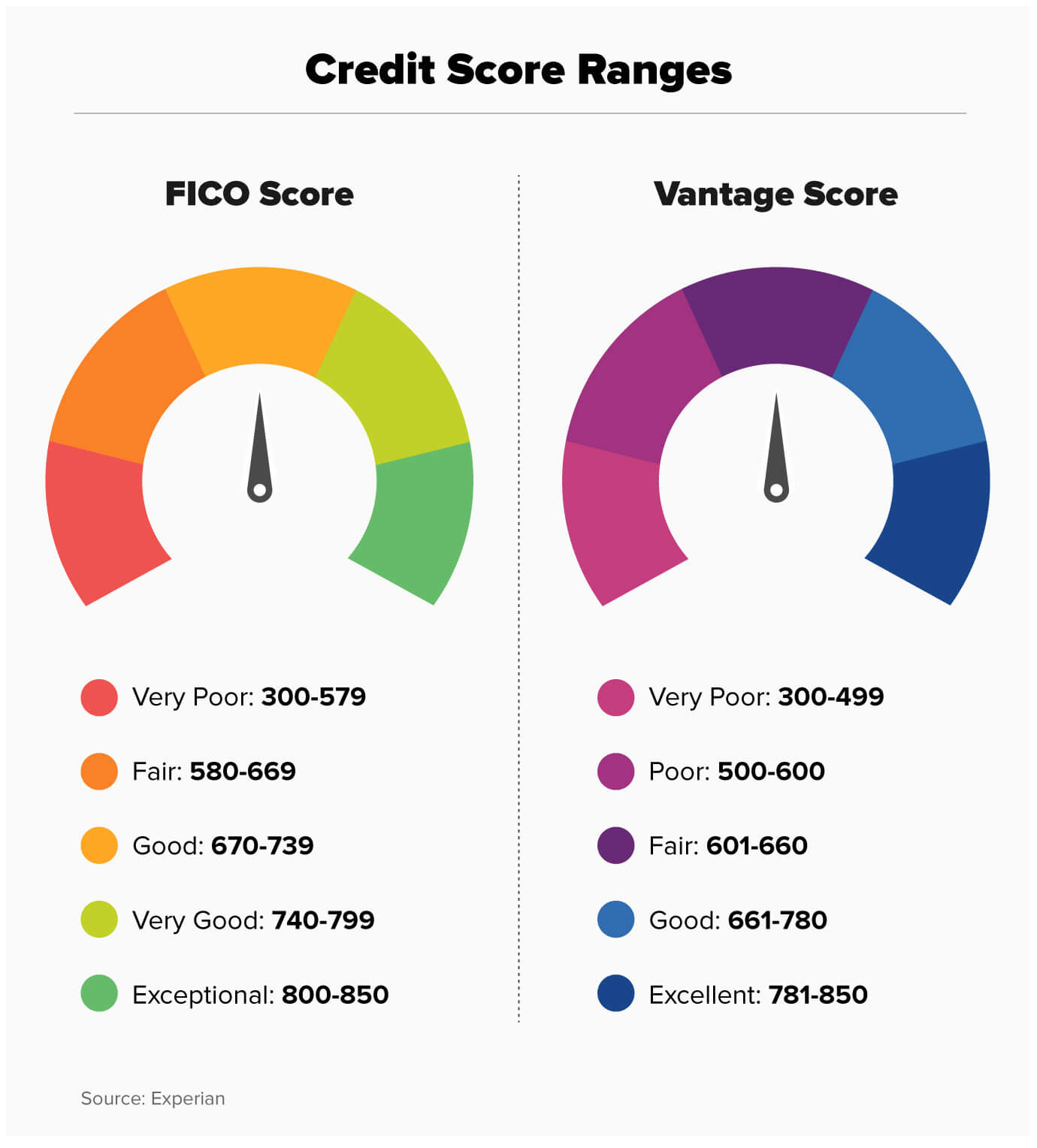

If you’re about to get a loan or credit, you must be asking yourself where a good credit score lies. Your credit score will always fall within a range of 300-850. 300 is termed as a poor rating, while 850 is considered excellent.

However, the credit score ranges vary depending on the credit scoring model used by your creditor. For example, when using the FICO scoring model, a score between 300 and 579 is considered very poor. From 580 to 669 is termed fair, 670 to 739 good, 740 to 799 is considered very good, and 800 to 850 is regarded as excellent.

On the other end, if the Vantage scoring model is used, the range between 300 to 499 is termed as very poor, 500 to 600 as poor, while the range between 601 to 660 is considered fair. If you want a good rating on this model, your score must be between 661 and 780. For an excellent rating, you must score between 781 and 850.

Whichever credit bureau (Experian, TransUnion, and Equifax) your lender uses will determine your final rating. Say, for instance, if your lender checks your report from Experian, they will get your Fico credit score. You’ll need to have a score ranging between 670 and 730 to be deemed fit for borrowing. On the other end, if your creditor checks your report with TransUnion, they will pull the report from VantageScore, and with a range of 661 to 780, you’re on the right mark.

However, it’s important to note that lenders use any of the three credit bureaus and don’t use the same every time. Therefore, it’s pretty difficult to predict which model your lender will use.

How are credit scores calculated?

Now that you understand the different ranges from the different credit-ranging models, you must be asking yourself how they get these figures. The truth is that each agency uses its algorithm, and this means that the details surrounding how to calculate your credit score is still a mystery. However, the figures on the FICO model are dependent on five credit score factors. They include:

- Payment History

Your payment history, the number one factor, takes 35% of your credit score. It’s an essential factor since one or two missed payments can significantly impact your credit score.

- Amount Owed

The number two factor is the total amount of debt you owe compared to the available credit. This accounts for about 30% of your credit score. Financial advisors will always advise that you keep this figure below 30% for a better credit score.

- Length of credit history

How long have you been borrowing? This is an essential factor your lenders need to confirm before doing any transaction with you. The longer you’ve been borrowing, the better your score. Your credit history accounts for 15% of your credit score.

- Credit Mix

Can you manage various debts, say, for example, mortgage, student loan, and credit cards, at the same time? If your accounts show that you can handle these debts efficiently, you stand a better chance of your credit score. Your credit mix accounts for 10% of your score.

- New Credit

Opening a new account now and then impacts your credit score. It accounts for 10% of your score. Opening new accounts within a short period shows the red light that you might be struggling to keep up with your bills. Therefore, if you get rejected for a credit card, it’s better to try your luck elsewhere or wait for a few months for your credit to improve.

How to improve your credit score?

Getting a good credit score is the first step to a good-paying job – and a low-interest credit card.

There’s no one recipe for getting a good credit score. You can improve your credit score and increase your chances of having a perfect credit score. But there’re plenty of other things that you can do to improve your score – and some that could even land you with a credit score upgrade.

They include:

- Pay your bills in full and on time

As mentioned earlier, your payment history takes up 35% of your credit score. So, if you want to raise your score, among the first things you should consider doing is sort your bills in full and on time. Whether it’s paying your mortgage, credit, or utility, you should prioritize this. If you’re late with the payments, it’s best to communicate with the lender or service provider to prevent them from reporting you to the credit bureau.

- Use a credit card little often

Another proven way to improve your credit score is to use your credit card a little often. Remember, having no credit to your name shows that you can manage to borrow regularly and gives your lender nothing to work on. Therefore, you should always settle your bills every month.

- Confirm if you’re linked to another person

Do you know that being linked with someone else with a poor credit rating can negatively impact your score? This can be through a mortgage, loan, or a joint account. If you notice you’re tied with someone lagging your score behind, your best call of action should be to cut them off, and this means contacting a credit reference agency to have their names removed from your credit report.

- Underutilize the credit made available to you

Using your credit cards is a proven way to keep your credit score healthy. It shows that you can handle the bills. However, if you want to keep the score even more healthy, be sure not to use more than 30% of your available credit at any time. For example, if your credit limit is $4000 and you spend $2000, your credit use will be 50%. It’s best to stick to the below 30% rule if you find yourself struggling with repayments.

- Go for a credit builder credit card

The only secret to dealing with a bad credit rating is building history to show that you can be responsible with credit. One of the best hacks to achieve exactly that is getting a credit builder card. This is easier to get as they accept individuals with low scores. If you conclude to follow this route, you must be willing to pay the card in full every month regardless of the monthly interest rates that go as high as 59.9%, which is normal.

- Avoid withdrawing cash on credit cards

While it may seem ok to source funds from your credit card, it’s a no. If you want to improve your score, among the habits you should resist is making cash withdrawals. By so doing, you’ll be showing your lenders how poor you’re when it comes to money management. You should, therefore, seek alternative means to source your cash other than credit cards.

- Pay your insurance upfront

While paying your home, car, and individual insurance upfront may sound expensive, it’s worth the chase if you want to keep your credit score in its best state. When signing up for insurance, you’re entering into a credit agreement. Your insurer will have to check your credit report to ascertain if you can pay them back. In return, these ‘hard checks’ can lower your credit score. So, it’s best to pay for insurance up front. It’s cheaper as opposed to the monthly payments.

Final Word

Although a three digit number, your credit score can significantly impact your financial freedom. When not ok, it can negatively impact your borrowing options. Luckily, there is still hope as you can take steps to improve your score, as shared in the article above. Read through the article to have a clear understanding of everything surrounding this critical topic.