The debt-to-equity ratio is the most common metric used to evaluate a company’s financial health. Whether you own a business or trying to assess your finances, it’s critical to understand what entails a good debt-to-equity ratio.

Knowing how to differentiate a good from a poor debt-to-equity ratio will help you better understand your company’s or personal financial standing. Here is a definitive guide on the debt-to-equity ratio and how it can help you achieve a stable financial ground.

What Is Debt-To-Equity Ratio?

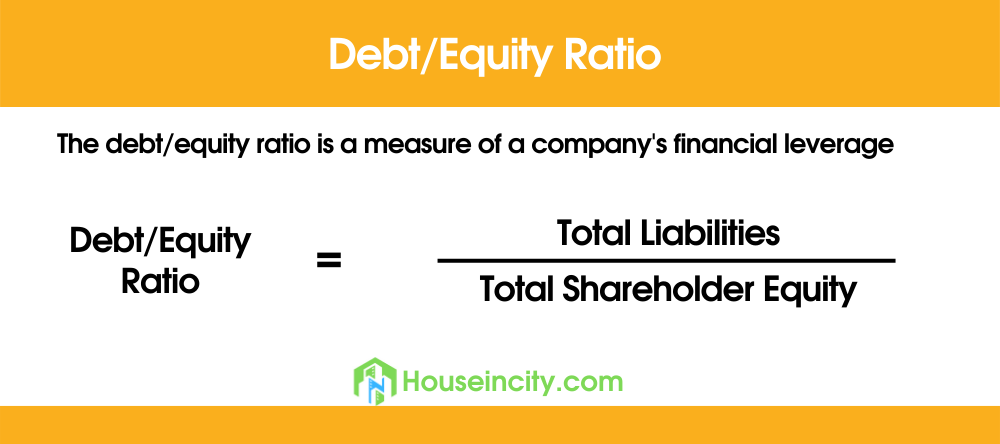

The debt-to-equity ratio is a leverage ratio that measures the weight of a company’s total debt and liabilities against its shareholder equity. In simple words, the debt-to-equity ratio lets you know how much a company uses to run its operations. It is sometimes known as the “debt-equity ratio” or “risk ratio.”

The debt-to-equity ratio is one of the things that the bank makes sure to assess before agreeing to lend you any amount of money. It is widely viewed as one of the most critical corporate metrics because it pinpoints a company’s dependency on borrowed budgets and its ability to fulfill those financial requirements.

You can know a company’s debt-to-equity ratio by looking at the company balance sheet.

How to Calculate Debt-to-Equity Ratio?

To calculate the debt-to-equity ratio, divide a company’s liabilities by its shareholder equity. Below is the debt to equity ratio formula explained:

Debt-to-Equity Ratio = Total liabilities / Total Shareholder Equity

For instance, if a company has a total of $50,000 in liabilities and $150,000 in shareholder equity, this is how to calculate debt to equity ratio

$50,000 / $150,000 = 0.33

The below formula can also be used to calculate the debt-to-equity ratio of your finances.

What is Considered a Good Debt-to-Equity Ratio?

A good debt to equity ratio is anything around 1 to 1.5. A ratio that’s higher than two is often considered risky. In addition, if the debt-to-equity ratio is below zero or negative, the company in question has more liabilities than assets. This particular company can be considered extremely risky since it may signify bankruptcy.

However, this also varies depending on the company’s stage and industry sector, as some industries require more debt financing than others.

Capital-intensive industries, such as the manufacturing and financial sectors, may have higher ratios than 2. Also, a newer company in its growing phase may be expected to have a higher D/E ratio than a more developed firm in most cases.

Do you Want a High or Low Debt-to-Equity Ratio?

Generally, a lower debt-to-equity ratio is preferred as it’s a good indicator of less debt on a company’s balance sheet. But, sometimes, a high debt-equity ratio can be good because it shows that a company can easily adhere to its debt obligations and is using the leverage to improve equity returns.

This means that you will need to understand better what is considered a too high or too low debt-to-value ratio.

As stated above, if the company’s ratio is negative, that can be viewed as too low. Moreover, anything higher than five is considered too high and unfavorable. So, a percentage of roughly 1.5 to 2.5 is considered better.

Importance of a Good Debt-to-Equity Ratio

A good debt-to-equity ratio is essential for several reasons.

In a business sense, lenders and investors use a firm’s D/E ratio to establish how risky an investment would be. A high ratio may mean a more risky investment because the company may not be able to repay the debt. Whereas a meager ratio may make the investors reluctant as it suggests that the firm doesn’t realize the potential value it could gain by borrowing funds and enhancing the scale of its operations.

When it comes to having an excellent personal debt-to-equity ratio means that you could qualify for many loans as an individual or a small business. This is because lenders will use your ratio to evaluate your willingness and ability to make your loan payments in the future.

For example, if you own more assets than liabilities, you’re more likely to continue repaying your loan – even if you lose your job for a couple of months.

Summary

The debt-to-equity ratio helps lenders and investors to identify companies that may pose risks in the future. But not all high or low ratios indicate poor business practices. Debt can be used as a catalyst to expand a company’s operations and generate additional wealth for its shareholders and the business.