Cap rate is the short form of capitalization rate, a fundamental indicator that’s widely used to determine whether an investor should pursue an asset or not. Typically, the cap rate is most used in the real estate sector where investors use it to optimize their real estate portfolios.

If you’re looking for long-term investment options, it’s essential that you understand the cap rate and how you can use it to pick the gems out of a pool of properties on sale.

Understanding Cap Rate

If you’re reading this, there’s a high likelihood you’ve been wondering what is cap rate. In layman’s terms, it’s a methodology to determine if an investment deal is worth the time and the money you’re about to dedicate to it.

The goal of the cap rate is to help you calculate the returns or losses you stand to make in a specific deal. While the methodology won’t give you guaranteed or exact figures, it points you in the general direction of where an investment decision is likely to take you – in profit or loss-making territory.

Still, the methodology is not infallible and is only as predictable as the stock markets. So, don’t rely solely on a cap rate when making investment decisions. Instead, pair it with due diligence and attention to detail and it may just lead you in the right direction.

How to Calculate Cap Rate

It’s essential that you calculate a property’s cap rate before you invest in it. In an investment portfolio, calculating the cap rate helps you estimate how long it will take before you recover your initial investment from the property.

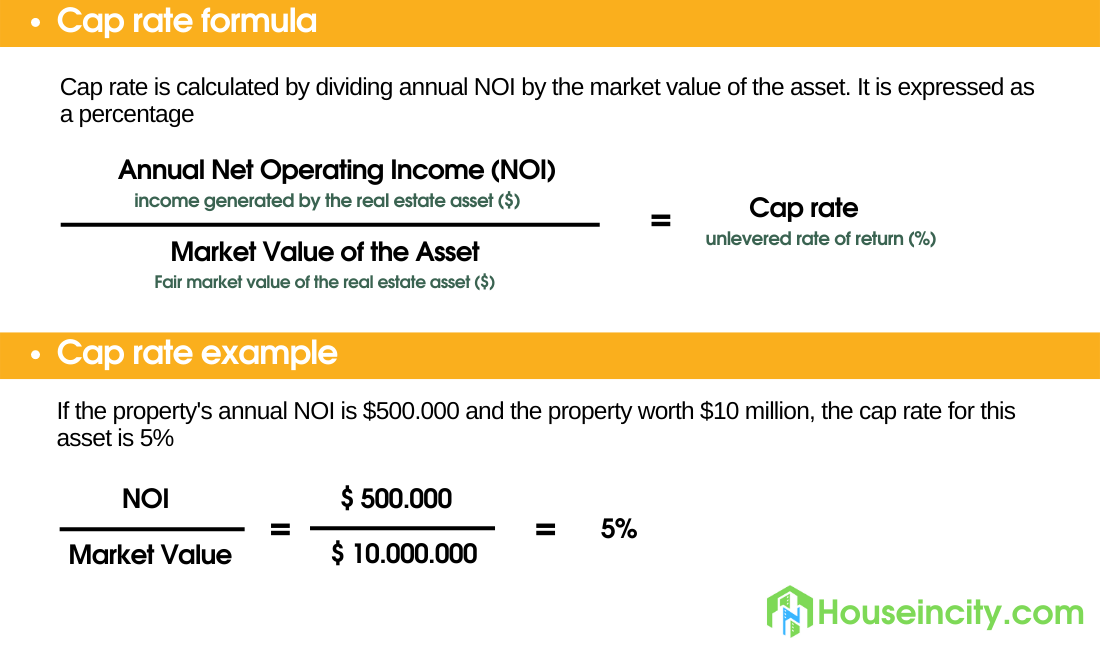

The following is the standard cap rate formula to get the percentage cap rate:

(Net Operating Income divided by Current Market Value) X 100 = Capitalization Rate %

While the formula above requires only basic math skills, getting the correct Net Operating Income (NOI) requires a bit more research. The only way to get the correct figure is to determine the income a specific property will be bringing in and subtract the total property expenses – maintenance, taxes, insurance premiums, etc.

Some investors use the purchase price to calculate the capitalization rate, but a property’s current market value is a more widely accepted metric, so it’s best to use it instead.

What is a Good Cap Rate?

A good cap rate depends on various factors, including:

- Location – riskier locations have higher cap rates and vice versa

- Market size – a competitive market with high demand is low risk, thus will have a lower cap rate

- Capital liquidity – how much you spend on the property, including on renovations directly impacts the NOI, thus also affects a property’s cap rate

- Growth potential – a high cap rate property may have a better ROI in the near future if it’s determined to have significant potential for growth

- Asset stability

For a commercial rental property located in a high-demand area, you’ll most likely make a good return if the property’s cap rate is approximately 4%.

On the other hand, if the property is in a low-demand area, you’ll want to target real estate investments with a cap rate of 10% or higher. Otherwise, you risk losing out on your investment. Nevertheless, a cap rate of between 5% and 10% is widely regarded as acceptable.

In essence, a property with a lower cap rate implies its low risk while those with a higher cap rate present an increased investment risk. So, cautious investors will often go for lower cap rate properties.

However, if you want a property you can purchase at a significant discount, you have a better chance of spending less on a property with a high cap rate.

When Should I Use Cap Rate?

You should use a cap rate if you’re buying or selling a rental property. However, most people who use this methodology are investors looking to invest in a rental property. Nevertheless, a property’s cap rate won’t help you if you’re evaluating an empty lot, fixer-uppers, or short-term rentals.

The formula to calculate relies on annual rental income, which means properties that are not rentals technically don’t qualify. So, which properties should you evaluate using a cap rate?

- Commercial real estate

- Apartment blocks

- Single and multifamily rental properties

- Rental townhouses

Final Verdict

If you’re considering investing in rental real estate, it’s essential you understand how a cap rate affects the potential to reap significant returns from your investment portfolios. Fortunately, with a little research and the information above, you’ll have the right foundation to help you choose investment properties wisely.