If you are wondering what ARV is in real estate, the definition is straightforward. The after-repair value or ARV is the estimated value of a piece of real estate after it has undergone all necessary repairs. House flippers use this calculation to determine the value of a property.

Flipped homes are not in the best condition; therefore, house flippers and real estate investors do not intend to purchase them at the current market value. Instead, they use the ARV formula to buy the property at a discounted price to turn a profit.

ARV in real estate is also used to secure a loan. Some lenders offer loans or renovation mortgages for home renovations. A homeowner can also use this calculation when renovating their home. This helps them determine how much value the repairs will add to their house.

How to Determine ARV In Real Estate

There are three steps involved in determining ARV in real estate. First, you should compile data for the property being purchased. You must gather information on the location, property specifications, school districts, and lot. The specific neighborhood or city, school districts the house is in, specific features of the property, and size of the property in square feet, all affect its estimated value.

Secondly, you need to compile data for comparable properties. Gather information on similar properties that have been renovated. This data will help you make correct estimates for property value before and after repairs. Furthermore, it enables you to identify the upgrades that most people value. Some resources that will help you with information on comparable properties include Zillow, Roofstock marketplace, and MLS reports from your local realtor.

Lastly, pit comparable properties against your subject property. Set a value range from low to high to see where your subject property factors on the scale before and after repairs. If your subject property is near the high-end range in its current condition, be careful investing a significant amount in renovations since there is a high risk of a lower overall return on investment. However, some cost-effective renovations like updating the landscape can lead to an increase in property value over time.

How to Calculate ARV

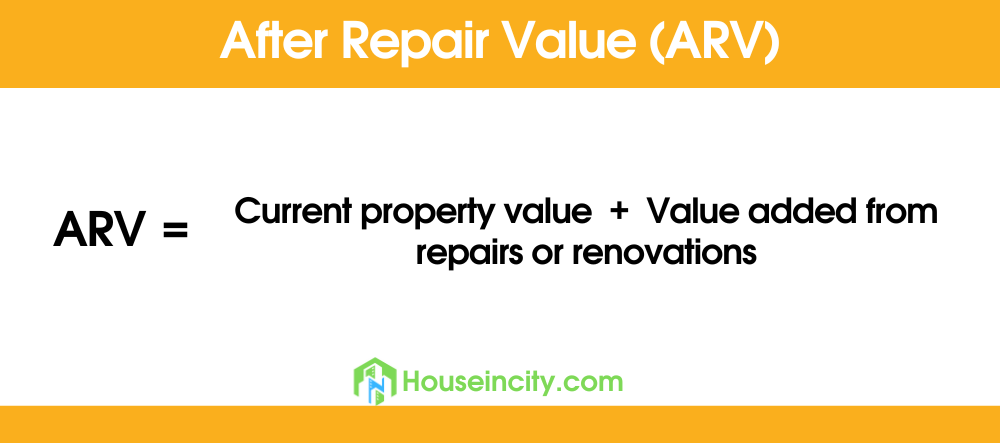

Some real estate websites have an ARV calculator that makes it easy to calculate the value of a property after renovations. However, if you want to know how to estimate ARV manually, the formula is as follows:

- ARV= Current property value + Value added from repairs or renovations

Typically, the current property value is equal to the purchase price of a property before any repairs. Value-added combines the cost of the renovations plus the value of the upgrades. For example, some people are unwilling to buy and renovate a house. However, they may be willing to pay a higher price to occupy a home that is already upgraded.

What Is the 70% Rule?

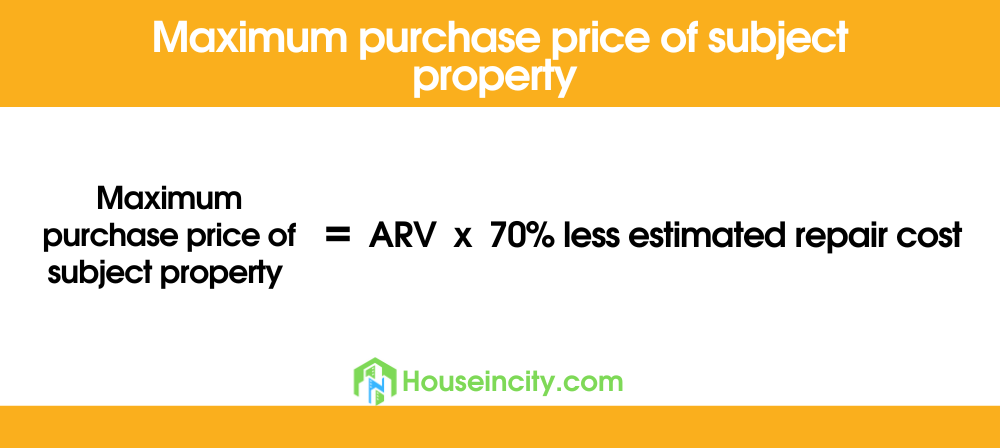

In addition to real estate ARV, investors interested in fixer-upper property use the “70% Rule,” also called the Golden Rule of Fixing and Flipping. When combining the 70% rule with ARV real estate, the value of the property is determined as follows:

- Maximum purchase price of subject property = ARV x 70% less estimated repair cost

For example, if the after-repair value of property is $150,000, the estimated cost of repairs is $30,000, the maximum purchase price based on the 70% rule is:

- $150,000 ARV x 70% = $105,000 minus $30,000 (estimated cost of repairs) = $75,000 maximum purchase price of the property

The 70% standard leaves a 30% margin of error if repair costs are undervalued or ARV is overestimated.

After Repair Value Limitations

The real estate market can change and cause home values to increase or decrease. Renovation costs may also vary, and there may be hidden property damage.

Additionally, an appraiser may give a different property value than an investor or realtor. Lenders often use appraisals which lead to a low pre-repair property value. Also, flippers have to be good negotiators when buying distressed properties to sell them after repairs. Therefore, a flipper who is good at how to estimate ARV but poor at negotiations may not receive the property’s ARV at sale time.

Wrapping It Up

ARV real estate term is a crucial calculation for homeowners, investors, and flippers. The value helps determine the cost of a property after repairs. This enables a homeowner to decide whether or not it’s worthwhile to repair their home to increase its value.

For investors and flippers, this calculation helps them decide whether investing in a property will provide profitable returns. However, ARV calculations have limitations depending on market conditions, appraiser valuations, and a flipper’s ability to negotiate for the best possible price.